So, Canada’s government has rolled out its shiny new 2024 budget with much fanfare, promising fairness and equity for all. At the heart of this budget is the plan to rake in a cool $20 billion by tweaking the capital gains tax rules. But hold onto your hats, folks, because if you think this windfall is coming solely from the pockets of those high-flying billionaires and faceless corporations, you might want to think again.

The Grand Illusion

The government proudly announces that only 0.13% of Canadians—those pesky, rich folks with their piles of money—will be affected by this tax change. “Don’t worry, average Canadians,” they say, “this isn’t about you. This is about making sure the super-wealthy pay their fair share!”

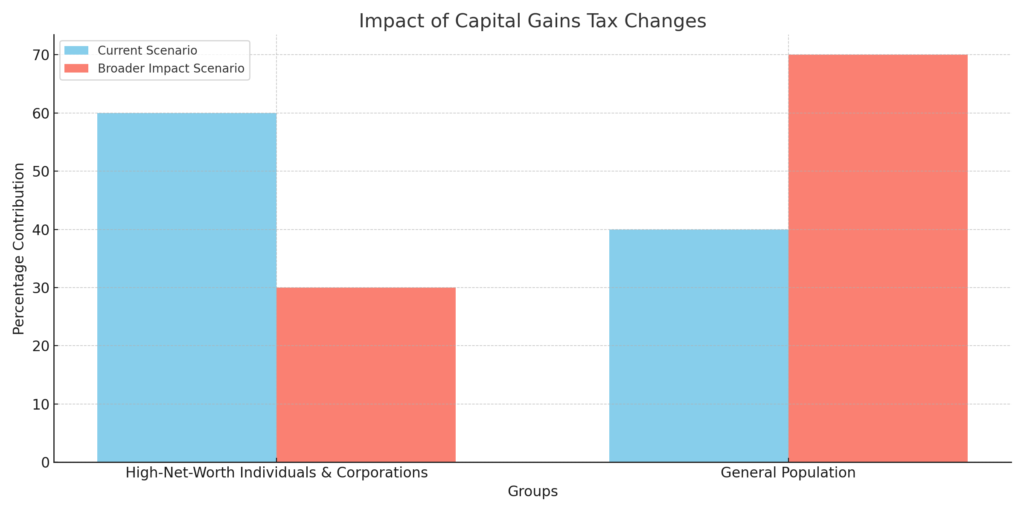

Enter the current scenario graph, showing 60% of the revenue coming from the high-net-worth individuals and corporations, and a modest 40% from the general population. It’s a picture-perfect promise of tax fairness. But wait, what’s this? A closer look reveals another scenario—the broader impact scenario—that flips the script. In this version, 70% of the revenue comes from the general population, and only 30% from the supposed wealthy targets.

Here is a bar graph comparing the projected revenue contributions from high-net-worth individuals and corporations versus the general population under two different scenarios:

- Current Scenario: High-net-worth individuals and corporations contribute 60% of the revenue, while the general population contributes 40%.

- Broader Impact Scenario: High-net-worth individuals and corporations contribute 30% of the revenue, while the general population contributes 70%.

This visualization clearly shows the difference in revenue contribution between the two scenarios.

The Reality Check

Let’s break it down. Sure, the government targets those making more than $250,000 in capital gains a year. Sounds fair, right? Except, when the average Joe sells his vacation home, liquidates his modest investment portfolio, or transfers the family farm to his kids, he suddenly finds himself in the crosshairs of this “fair” tax.

Imagine Grandpa Joe, who bought a small cottage years ago for $100,000, now selling it for $500,000 to fund his retirement. Under the new rules, Joe’s not-so-little nest egg gets whacked with a hefty tax bill. Surprise! The tax man cometh, not for the corporate titan, but for your dear old Grandpa Joe. And let’s not forget the small business owners, who, after years of hard work, decide to sell their businesses as they head into retirement. They too are about to get a rude awakening.

The Great Canadian Tax Magic Show

But here’s where the magic trick gets really good. Once that $20 billion is conjured up from the combined efforts of the general populace and the occasional fat cat, where does it all go? You guessed it—into the government’s bottomless, black pit of zero accountability. Imagine a giant black hole where taxpayer dollars disappear, never to be seen or heard from again.

Healthcare, infrastructure, education? Maybe. But try getting a clear answer on how precisely this newfound fortune will be spent. It’s like trying to find a unicorn in a haystack—good luck with that!

The Real Winners

In the end, the government’s projection is less about fair taxation and more about pulling a fast one on the average Canadian. The wealthy might feel a pinch, but it’s the everyday folks, those who sell a property or pass on their hard-earned assets to loved ones, who will bear the brunt of this “fair” tax policy. And after the dust settles, our tax dollars will vanish into the abyss of governmental spending, leaving us all to wonder what just happened.

So next time you hear about the government’s plans to make the rich pay their fair share, remember Grandpa Joe and his cottage, and take a closer look at the man behind the curtain. Because in this magic show, the trick’s on us.

References:

- Government of Canada: Fair and Predictable Capital Gains Taxation

- Global News: Budget 2024: Taxes on capital gains explained

- RBC: Federal Budget 2024: What are the proposed capital gains tax changes and how might they affect me?